USDCHF Weekly Forex Forecast – 3rd to 7th Dec 2018

Fundamentals Outlook

The week ahead is expected to be busy with the start of a new trading month. Data over the week includes some key reports from the U.S. such as the ISM’s manufacturing and non-manufacturing PMI due earlier in the week. The ADP private payroll numbers followed by the official non-farm payrolls on Friday will cap the data from the U.S.

In the Eurozone, the monthly manufacturing and services PMI figures will be coming out. The data will likely give more details on how the Eurozone economy fared in the month of November. The Sentix investor confidence report will also provide more details on the business sentiment in the Eurozone area. A relatively quiet week from Switzerland will see only the release of the monthly inflation figures. Data from Japan is quiet this week with only the household spending report due.

501% Growth in 12 months of trading! Click Here to learn more…

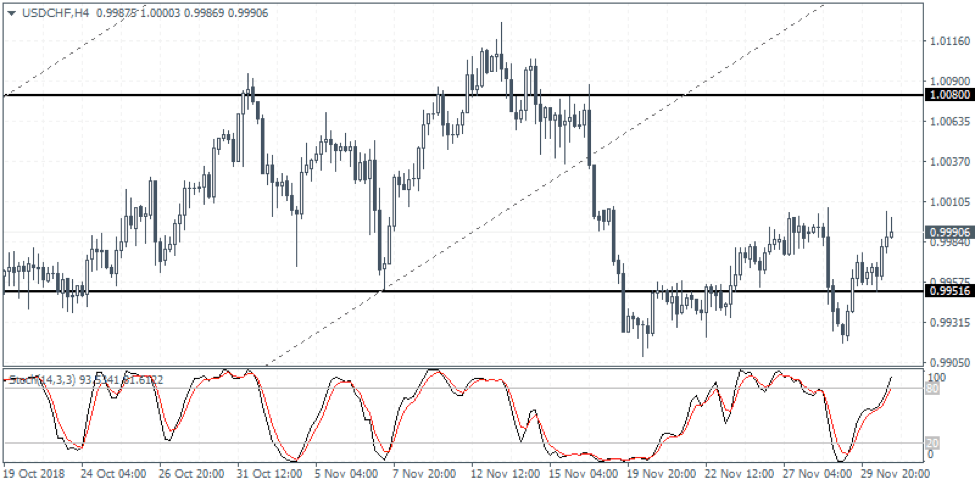

Chart set up: The USDCHF currency pair continued to consolidate around the support level of 0.9951. Price action was seen to be repeatedly testing this level albeit briefly slipping below the support a few times. Still, with the short term bias to the upside, the USDCHF currency pair could be seen attempting to test the breakout level from the rising price channel at the very least..

Key support/resistance levels:

Support: 0.9951; Resistance: 1.0080

Commentary:

As the USDCHF continues to maintain a sideways, range, the bias is to the downside. This can be validated as long as price action does not breach the resistance level of 1.0080. The USDCHF currency pair has also turned flat in the medium term, indicating that we could expect to see further ranging price action in the near term. A strong breakout from the mentioned levels is needed for the USDCHF currency pair to form the next leg in the trend. For the week ahead, USDCHF is expected to be flat.

This is the simple way to scan for the best price action setup everyday. Click Here…

The post USDCHF Weekly Forex Forecast – 3rd to 7th Dec 2018 appeared first on Advanced Forex Strategies.

from Advanced Forex Strategies