USDCHF Weekly Forex Forecast – 1st to 5th Jan 2018

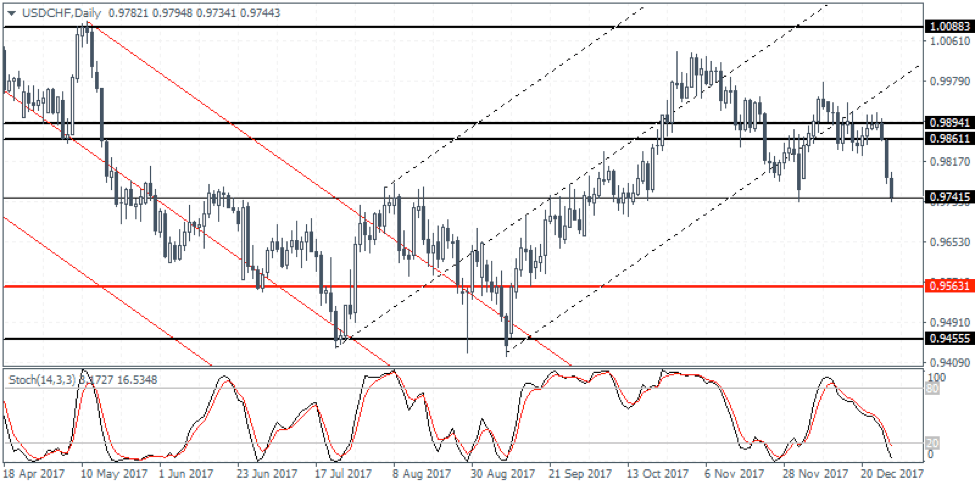

Technical Outlook: USDCHF closed the week after price briefly fell to 0.9741 support level. The decline to the support level came amid price failing to break past the resistance level that was established near 0.9894 – 0.9861 level. Further declines cannot be ruled out but a break down below the support level could see the USDCHF declining towards 0.9563 level of support. In the short term, price action in USDCHF could be seen consolidating within 0.9861 – 0.9741 region. A breakout from this level will establish further direction in the short term but the bias remains to the downside.

Fundamental Outlook: The week ahead is quiet for the Swiss franc which will see the manufacturing PMI report and the inflation data for the month. The focus will shift to the U.S. which will see a very busy week ahead. Data includes the ISM’s manufacturing and non-manufacturing reports including the release of the FOMC meeting minutes on Wednesday. The monthly private payrolls data from ADP is due on Wednesday and will see the first non-farm payrolls data of the year coming out on Friday. The payrolls report covers the period of December.

Previous USDCHF Weekly Forex Forecast

USDCHF Weekly Forex Forecast – 1st to 5th Dec 2017

The post USDCHF Weekly Forex Forecast – 1st to 5th Jan 2018 appeared first on Advanced Forex Strategies.

from Advanced Forex Strategies

No comments:

Post a Comment