#Cisco Files Patent Application Around #Blockchain, #IoT Integration https://t.co/jJRqJ852Ur

[MORE]

Before you continue, we want to make sure you understand that this is a past trade idea found inside The Price Action Club which is a premium Price Action trade signal service. This post is 1 week delayed and this idea is no longer valid but the lesson is still valid. We post this to show you what is inside the Price Action Club. It would be awesome if you join us to learn and to trade our trade ideas. We hope to see you inside the Price Action Club soon. Click here to join us…

Join The Price Action Club Here…

CADJPY has been trapped within an uptrending channel. The price is right at a support level of that channel. Thus, it might be the time for the buyers to get ready to start buying the pair after a good bullish H4 signal. Let us have a look at the H4 CADJPY channel…  Have a look at the H4 chart. The level of 90.615 has the potential to be a strong level of support since it is a mixed of horizontal and channel support. Now what buyers have to wait here for is a good bullish H4 candle to start buying the pair.

Have a look at the H4 chart. The level of 90.615 has the potential to be a strong level of support since it is a mixed of horizontal and channel support. Now what buyers have to wait here for is a good bullish H4 candle to start buying the pair.

CADJPY Price Action Analysis – 22nd Sept 2017

If the pair produces an H4 Bullish Engulfing Candle, then wait for a little correction on the H1 chart. Once there is an H1 Bullish candle is produced, and then buy the pair. Most probably, that H1 Bullish candle will be produced at 91.250. Let us have a look at the summary of the trade

There are some high impact news events about the CAD today at 12.30 GMT. Thus, it would be best if the buying signal comes after the news event. If the price makes the breakout during the news event, but takes too long to produce the signal, then we might as well not take the entry today since it is Friday today. Nevertheless, we might get another chance to take the entry on the next Monday.

You can also take a look at our previous (and most likely profitable) Free Forex Trading Signals Here.

We hope that you enjoy our Free Forex Trading Signal today. EURNZD Price Action Analysis – 20th Sept 2017

Join The Price Action Club Here…

The post CADJPY Price Action Analysis – 22nd Sept 2017 appeared first on Advanced Forex Strategies.

Before you continue, we want to make sure you understand that this is a past trade idea found inside The Price Action Club which is a premium Price Action trade signal service. This post is 1 week delayed and this idea is no longer valid but the lesson is still valid. We post this to show you what is inside the Price Action Club. It would be awesome if you join us to learn and to trade our trade ideas. We hope to see you inside the Price Action Club soon. Click here to join us…

Join The Price Action Club Here…

EURAUD broke a significant level of support and produced some good-looking bearish H4 candles yesterday. The price has been on a correction so far today. However, the price is right there where the breakout level is. This means if the level is held and the pair produces an H4 Bearish Engulfing Candle right at that level, then selling the pair would get us some green pips. Let us have a look at the H4-EURAUD chart…

EURAUD Price Action Analysis – 21st Sept 2017

Have a look at those H4 bearish candles. The price breached through the level of 1.48750, which was a support level where price got bounced number of times. The breakout candle and overall selling pressure is good as well. Now what sellers have to wait for here is an H4 Bearish Engulfing Candle to take a sell entry. Let us have a look at the summary of the trade…

The current candle might not be the Engulfing candle that we are aiming for. As far as I am concerned, it might come out as a Doji candle or a bearish candle with a short body. Thus, we must keep our eyes on the chart once the current H4 candle finishes. If it is an Engulfing bearish candle, we take our sell entry. If it is not, then we wait for the next one to take the entry. If we get an inside bar (bearish), we had better avoid taking the entry.

You can also take a look at our previous (and most likely profitable) Free Forex Trading Signals Here.

We hope that you enjoy our Free Forex Trading Signal today. EURNZD Price Action Analysis – 20th Sept 2017

Join The Price Action Club Here…

The post EURAUD Price Action Analysis – 21st Sept 2017 appeared first on Advanced Forex Strategies.

Before you continue, we want to make sure you understand that this is a past trade idea found inside The Price Action Club which is a premium Price Action trade signal service. This post is 1 week delayed and this idea is no longer valid but the lesson is still valid. We post this to show you what is inside the Price Action Club. It would be awesome if you join us to learn and to trade our trade ideas. We hope to see you inside the Price Action Club soon. Click here to join us…

Join The Price Action Club Here…

EURNZD has been bearish on the H4 chart. The price has been trapped within a down trending channel. Today, the pair reacted on the resistance of that channel again by making a huge bearish move. It is the time for the sellers to wait for a correction. If the price goes back to that breakout level and gives us a Bearish Engulfing Candle, then selling the pair would give us some green pips. Let us have a look at the H1-EURNZD chart…

Look at that huge bearish H1 candle. It broke through a massive level of support at 1.63580. The next candle is an Inside bar though. However, the price would need another level of resistance to attract more sellers from here. The best level of resistance here would be the breakout level at 1.63580. If the price goes back there and produces a Bearish Engulfing Candle, then there should be huge selling pressure to take the price further down. Let us have a look at the summary of the trade…

Look at that huge bearish H1 candle. It broke through a massive level of support at 1.63580. The next candle is an Inside bar though. However, the price would need another level of resistance to attract more sellers from here. The best level of resistance here would be the breakout level at 1.63580. If the price goes back there and produces a Bearish Engulfing Candle, then there should be huge selling pressure to take the price further down. Let us have a look at the summary of the trade…We have FOMC today. Thus, most of the pairs have been sluggish today. NZD and AUD pairs look good though. Since EURNZD is a non-US pair, thus it might go technically from here and produce the signal that we are eying on. We have to make sure that the signal comes at least 2 hours earlier than the FOMC meeting minute though.

You can also take a look at our previous (and most likely profitable) Free Forex Trading Signals Here.

We hope that you enjoy our Free Forex Trading Signal today. EURNZD Price Action Analysis – 20th Sept 2017

Join The Price Action Club Here…

The post EURNZD Price Action Analysis – 20th Sept 2017 appeared first on Advanced Forex Strategies.

Before you continue, we want to make sure you understand that this is a past trade idea found inside The Price Action Club which is a premium Price Action trade signal service. This post is 1 week delayed and this idea is no longer valid but the lesson is still valid. We post this to show you what is inside the Price Action Club. It would be awesome if you join us to learn and to trade our trade ideas. We hope to see you inside the Price Action Club soon. Click here to join us…

Join The Price Action Club Here…

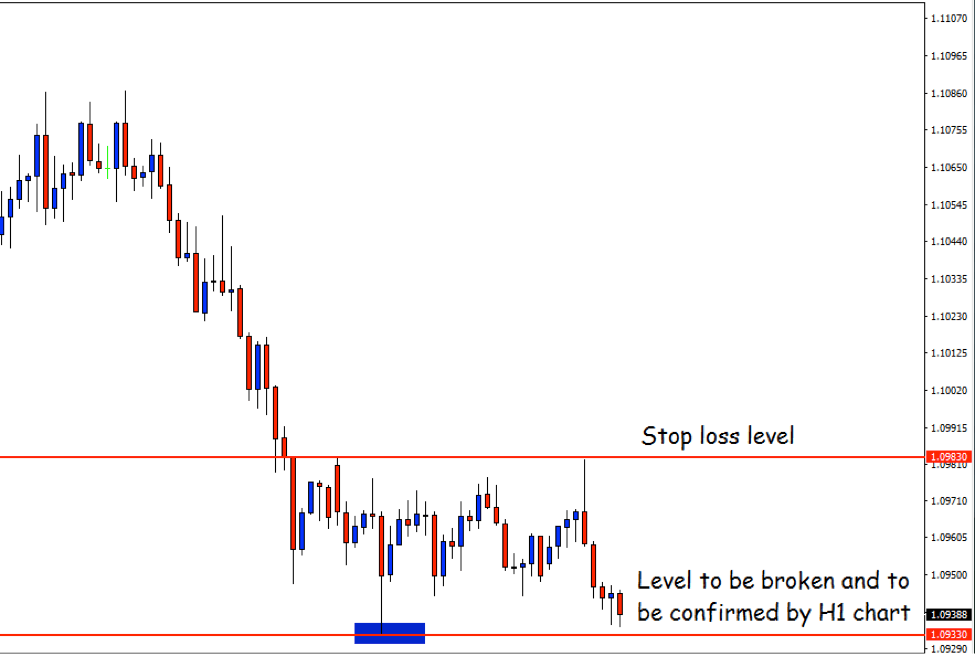

AUDNZD has been having a sell trend on the H4 chart. The pair seems to keep making lower lows with a fair amount of selling pressure. Today’s first H4 candle is a solid bearish candle. There is a strong support level to be broken. If that is broken and confirmed by the H1 candles, then we might get a selling opportunity on the pair with excellent risk and reward ratio. Let us have a look at the H1 AUDNZD chart.

AUDNZD Price Action Analysis – 19th Sept 2017

Have a look at the bearish move here. Earlier today, the pair produced a huge bearish Engulfing candle and then the price has kept coming towards the down side. The level of 1.09330 is a level of support though, where price had a rejection. Thus, this level has to be broken first. If this level gets broken by a massive H1 candle and the price comes back to this breakout level again, then sellers should wait for an H1 bearish Engulfing candle right at this level to take a sell entry. Let us have a look at the summary of the trade…

As it seems the setup might take at least two H4 candles to produce the signal. This means the signal would come after the New York session. Since it is AUDNZD so it is not directly related to the US session. Thus, to hit the target we might have to run the trade until tom tomorrow.

You can also take a look at our previous (and most likely profitable) Free Forex Trading Signals Here.

We hope that you enjoy our Free Forex Trading Signal today. AUDNZD Price Action Analysis – 19th Sept 2017

Join The Price Action Club Here…

The post AUDNZD Price Action Analysis – 19th Sept 2017 appeared first on Advanced Forex Strategies.

Before you continue, we want to make sure you understand that this is a past trade idea found inside The Price Action Club which is a premium Price Action trade signal service. This post is 1 week delayed and this idea is no longer valid but the lesson is still valid. We post this to show you what is inside the Price Action Club. It would be awesome if you join us to learn and to trade our trade ideas. We hope to see you inside the Price Action Club soon. Click here to join us…

Join The Price Action Club Here…

EURAUD has been trapped within a Down trending channel as far as the H4 chart is concerned. The price had a rejection. It seems that the price is heading towards the South again. Today, the pair produced a massive H4 Bearish candle. Thus, an inside bar(H4) might help the pair make new lower low. Let us have a look at the H1 EURAUD chart…

![]()

See those massive H1 bearish candles. The price breached through the level of 1.49100. As it seems that, the price is going back to that breakout level for a correction. If it does, and produces an H1 Bearish Candle, then selling the pair would get us some green pips. Let us have a look at the summary of the trade

This trade setup is a combination of H1 and H4 chart. We have to wait until the current H4 candle to be finished within the potential Support level. We will get an H4 inside bar then, which is an excellent signal to ride on a trend. Once we get the H4 inside bar, then we wait for that H1 Bearish Engulfing Candle to be produced right from that support level. If these two conditions are met, then it would be an excellent sell signal. If one of these is missing, then the trade setup might take more time to hit the take profit level or might not go there at all.

You can also take a look at our previous (and most likely profitable) Free Forex Trading Signals Here.

We hope that you enjoy our Free Forex Trading Signal today. EURAUD Price Action Analysis – 18th Sept 2017

Join The Price Action Club Here…

The post EURAUD Price Action Analysis – 18th Sept 2017 appeared first on Advanced Forex Strategies.

At least for now. European leaders are meeting in Brussels and Brexit is high on the agenda. This is the summit in which the remaining EU 27 members are supposed to assess whether enough progress has been made on Brexit negotiations. The EU forced the UK to agree to sequencing early in the summer: the parties [...]

The post Merkel provides some help to May – Sell opportunity on GBP/USD? appeared first on Forex Crunch.

USD/JPY is currently trading at 113.30, after already reaching a peak of 113.46. This is the line that it reached earlier in the month and also in July. The drivers come from both sides of the currency pair. Can it reach even higher ground? In the US, the Senate took the first step in approving [...]

The post USD/JPY hits high resistance on US tax talk, upcoming elections appeared first on Forex Crunch.