a-ads

Tuesday, September 19, 2017

CryptoCurrency News: Pick n Pay Double Take? The Supermarket Chain Isn't Accepting Bitcoin, It Tested It

via CoinDesk

CryptoCurrency: Ethereum News September 20, 2017 at 05:43AM #ETH

[MORE]

CryptoCurrency News: World's Largest Hedge Fund Founder: Bitcoin is a 'Bubble'

via CoinDesk

CryptoCurrency News: $700 Billion Senate Defense Bill Calls for Blockchain Cybersecurity Study

via CoinDesk

CryptoCurrency News: Ethereum's Byzantium Testnet Just Verified A Private Transaction

via CoinDesk

CryptoCurrency News: Bull Signal? Bitcoin's Price Breaks Above 50-Day Moving Average

via CoinDesk

CryptoCurrency News: Mexican Law Would Give Central Bank Oversight of Cryptocurrency Startups

via CoinDesk

CryptoCurrency News: Bullish Breakout: Is the Ether Price Heading Back Above $300?

via CoinDesk

CryptoCurrency News: Blockchain Truce? Putin's Internet Adviser Calls for US-Russia Cooperation

via CoinDesk

CryptoCurrency News: Only in Arizona: How Smart Contract Clarity Is Winning Over Startups

via CoinDesk

[FOREX NEWS] ECB “sources” send EUR/USD down 30 pips – a buying opportunity?

According to Reuters, which usually has access to ECB sources, the European Central Bank cannot agree on setting a final date for its bond-buying scheme. EUR/USD falls from 1.1990 to 1.1960. Two weeks ago, president Mario Draghi told us that the ECB will probably reach a decision on QE in its October decision. He also [...]

The post ECB “sources” send EUR/USD down 30 pips – a buying opportunity? appeared first on Forex Crunch.

via Forex Crunch

CryptoCurrency News: Ethereum's Next Hard Fork Is Now Officially Being Tested

via CoinDesk

CryptoCurrency News: Proof of Space: BitTorrent Creator Publishes Eco-Friendly Mining Paper

via CoinDesk

CryptoCurrency News: The Economic Case for Conservative Bitcoin Development

via CoinDesk

[FOREX NEWS] German ZEW Economic Sentiment bears with 17

Businesses are more confident ahead of the elections in Germany. The ZEW Economic Sentiment is up 7 points to 17 in September. The Current Conditions measure is up from 86.7 to 87.9. EUR/USD moves up by a few pips, trading at 1.1985. Germans will vote on Sunday and incumbent Angela Merkel is expected to sweep [...]

The post German ZEW Economic Sentiment bears with 17 appeared first on Forex Crunch.

via Forex Crunch

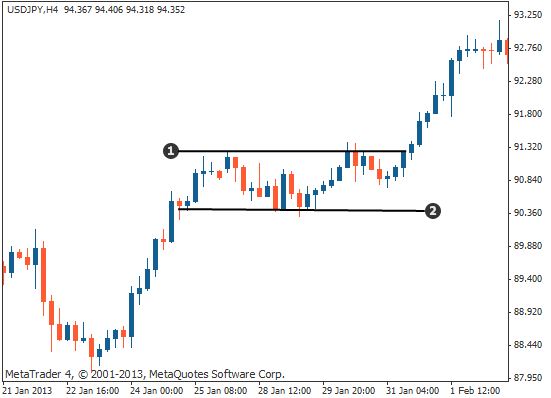

[FOREX TIP] Breakout Trading Strategy Using the Rectangle Chart Pattern Analysis

Trading the Rectangle Chart Pattern requires Patience

The Rectangle Chart Pattern is one of the most commonly recurring themes in the Forex markets. As you may know, price tend to move in trends and in between, prices undergo periods of consolidation. This consolidation can take shape in different forms, the rectangle chart pattern being one of them.

This horizontal consolidation in price occurs usually after a strong trending move (uptrend or downtrend). Following this move, price action tends to settle down into a horizontal range. This horizontal range can take the shape of a rectangle. Price tends to move in this range for a significant amount of time, following which a breakout occurs.

Typically, the rectangle chart pattern can occur as a continuation pattern. This means that when you see a rectangle chart pattern after an uptrend, you can expect price to continue to the upside, and vice-versa for the downtrend. But this is not the case all the time. Besides acting a reversal chart pattern, the rectangle chart pattern can also signal a reversal pattern, which will see prices moving in the opposite direction.

However, such reversal rectangle patterns can be seen either at the tops or at the bottoms of a price trend. The rectangle pattern typically occurs in stocks where prices tend to move sideways for a couple of months, if not longer. Trading with the rectangle pattern can be done in almost all markets and across all timeframes. The logic behind this pattern being that is quite simple to catch the rectangle chart pattern with relative ease.

However, in order to be successful with the rectangle chart, patience is of the essence. Taking an entry ahead of the breakout can result in the position being caught on the wrong side and can lead to significant losses. Secondly, as with all chart patterns, some discretion is required.

How is the Rectangle Chart Pattern formed?

The Rectangle Chart Pattern, as the name suggests evolves as prices move within a specified range. The highs and lows are formed and price tends to range within these levels for a considerable period of time. This period is also known as accumulation period and comes ahead of a new trend.

The rectangle pattern needs at least two reaction highs and two reaction lows. In other words, there has to be two highs and two lows formed for the rectangle pattern to be created. These levels are also known as resistance and support levels. In some markets where volume is applicable, you can notice volume can be random at best when the rectangle pattern is formed.

Still, the volumes within these consolidation periods are lower. The pattern can last for weeks or months, or even hours, depending on the time frame which forms the context. The chart below shows how a typical rectangle pattern is formed. In figure 1, you can see how price moved into a sideways range, forming the rectangle chart pattern. This was later followed by a bullish breakout to the upside. You can also see how the rectangle pattern was formed after price previously declined, thus making this pattern a reversal pattern in this instance.

Figure 1- Rectangle Chart Pattern Breakout

Bullish Rectangle Chart Pattern in an Uptrend

A bullish rectangle pattern is formed in an uptrend and can signal a continuation of price, provided the breakout is to the upside. Alternately, a downside breakout from the rectangle pattern after an uptrend can result in a reversal breakout and can signal declines in prices.

Figure 2: Bullish and bearish rectangle breakout

Bearish Rectangle Chart Pattern in a Downtrend

In a bearish rectangle pattern, you can typically see a downtrend in price following which the consolidation takes the shape of a rectangle pattern. From this consolidation, a downside breakout will signal a continuation to the previous downtrend. However, if price reverses and breaks out to the upside, the bullish rectangle pattern will be a reversal pattern in this instance. Figure 2 depicts both a bullish and a bearish rectangle patterns including the minimum price objective following the breakout.

Rules for Trading the Rectangle Chart Pattern Formation

Trading the rectangle pattern breakout is very simple. First identify the pattern where you can see a minimum of two highs and two lows being formed within a sideways range. The next step is to determine the direction of the breakout.

Once the breakout direction is detected, then measure the distance of the rectangle from the high to the low and then project the same from the breakout level which becomes the minimum target level. You can set the stop losses to the previous swing low (for a bullish rectangle breakout) or the previous swing high (for a bearish rectangle breakout). Sometimes, the breakout when accompanied by strong volume can also signal another validation to the trade which traders can bear in mind.

Trading the Rectangle Formation as a Reversal Chart Pattern Strategy

The reversal rectangle is ideally seen at the tops or at the bottoms of an uptrend or a downtrend. However, there is no telling that a rectangle pattern formed at the top (or a bottom) will signal a reversal as sometimes, this could be a continuation pattern as well. Therefore, it is always best for traders to wait for the breakout from the rectangle pattern and trade accordingly.

To conclude, the rectangle pattern is quite simple and can signal some good breakout strategies. However, due to the fact that the minimum price projection is just the height of the rectangle, the profits can be limited especially when price moves strongly in the direction of the breakout.

The post Breakout Trading Strategy Using the Rectangle Chart Pattern Analysis appeared first on Advanced Forex Strategies.

from Advanced Forex Strategies

[FOREX NEWS] Fed Preview: a window to short the dollar and two other scenarios

The Federal Reserve will begin reducing its $4.5 trillion balance sheet, in a very gradual manner. This has been well telegraphed for months and months. Yellen told us that it will be “like watching paint dry”. So, no surprises from the main policy decision. Markets will move on speculation for the next rate hike. Back [...]

The post Fed Preview: a window to short the dollar and two other scenarios appeared first on Forex Crunch.

via Forex Crunch

[FOREX NEWS] AUD/USD remains pressured by the RBA

After the ECB and then the BOC complained about the exchange rate, the RBA followed suit. It seems that everybody except the BOE wants a lower currency. For Australia’s central bank, it is certainly not the first time. While the recent meeting minutes do not shed any surprising new light, they serve to keep the [...]

The post AUD/USD remains pressured by the RBA appeared first on Forex Crunch.

via Forex Crunch

[FOREX NEWS] EUR/USD: S/T Tactical Downside Before Higher Again; Where To Target? – ABN AMRO

EUR/USD is flirting with the 1.20 level once again, but with lots of caution. Where next? Here is their view, courtesy of eFXnews: ABN AMRO FX Strategy Research argues that in the near-term net-long position liquidation will probably push EUR/USD towards 1.15, but later in the year expects EUR/USD to move back above 1.20. “We expect the [...]

The post EUR/USD: S/T Tactical Downside Before Higher Again; Where To Target? – ABN AMRO appeared first on Forex Crunch.

via Forex Crunch

CryptoCurrency News: $9 Million: Bitcoin Startup Luno Completes Series B Funding

via CoinDesk

Popular Posts

-

Asset management giant BlackRock's top strategist shared his views on cryptocurrency markets in new comments. Source via CoinDesk

-

Bitcoin cash has rallied sharply from recent lows, but still remains trapped inside a bearish pattern, price charts indicate. via CoinDe...

-

Leading U.S.-based cryptocurrency exchange Coinbase is suffering connectivity issues for the second consecutive day amid bitcoin‘s parabol...

-

The bill would potentially kick off the development of a digital rupee while banning “private cryptocurrencies.” via CoinDesk

-

Earlier, we reported that Chinese Cryptocurrency exchanges are looking into migrating their operations to other countries . But while that...

-

The news comes a day after former Chairman Jay Clayton announced that yesterday was his last day. via CoinDesk

-

There are some very good reasons, it turns out, rooted in our deep, totally irrational animal brains. via CoinDesk

-

Brits are buying once again. Is this an Easter effect? Perhaps GBP/USD likes the data and breaks above 1.30. The UK was expected to report a...

-

Bitfury Group is announcing its first major step into the enterprise blockchain sector with the launch of its Exonum software solution. Sour...

-

In a potential first for the crypto investment sector, two U.S. public pension funds are dipping their toes in Morgan Creek's latest v...