Support and resistance levels are one of the key cornerstone elements when it comes to trading. It not just applies to the forex markets but nearly any financial market that you want to analyze. Whether you are trading based off indicators or price action there is no way one can avoid learning about support and resistance levels. Therefore it is important for the trader to thoroughly understand what these levels are and what they mean for your trading.

The Importance of Support and Resistance

Not understand how support and resistance levels work can be disastrous to your trading. Most traders seek the easy way out and make use of custom technical indicators that can plot these levels. Easy and convenient as it may sound, the fact remains as the trader is still dependent on these indicators. And many a times, the automated support and resistance levels don’t work as promised.

This is because there is some subjectivity involved when it comes to plotting these levels, something which an indicator cannot do. Therefore, the sooner one learns how support and resistance works, the better they can improve their trading. Let’s begin by first understanding what is support, and what is resistance?

Definition of Support

Support level is defined as technical level in a price chart where there is a lot of demand for the security. Because of this demand, traders tend to buy the security in question, thus leading to a “support.”

When price trades at a support level it will appreciate or rise or rally from the support level. Obvious from the above definition, you never make the mistake of selling at a support level. From a trading standpoint however, you can buy from a support level or you can target your short position to a support level.

Definition of Resistance

Resistance levels are defined at a technical level in a price chart where there is a lot of supply or selling pressure at a particular price or at a price region. Due to this strong measure of supply or sellers, prices often fall due to the heavy selling. Again, it is obvious that you never buy at a resistance level. On the contrary, you can target your long positions to a resistance level or you can sell at a resistance level.

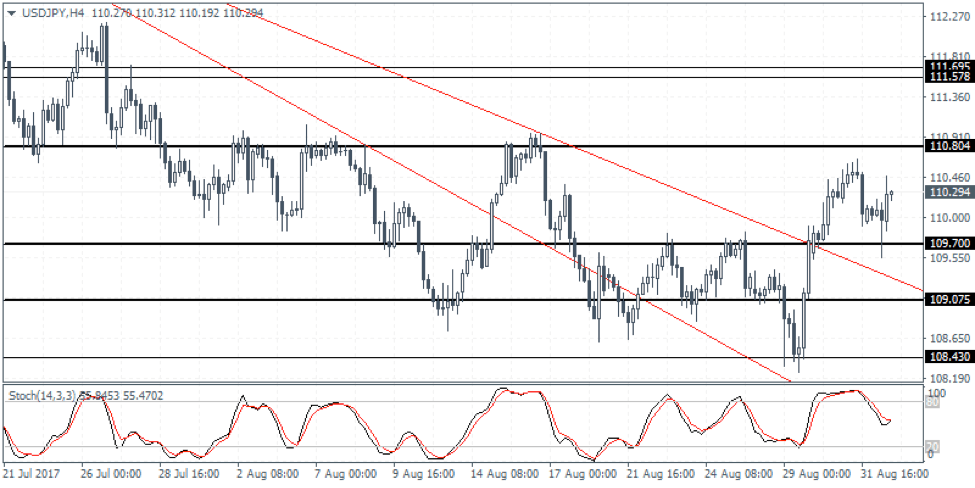

Most traders make the mistake of thinking that support and resistance levels are just mere price points. They are partly right. A support or a resistance level can either be a single price point or it can be a region as well. For example, in USDJPY 110.25 might be a support, but 112.25 – 112.00 can also be a support region or a level of demand. It is always best to have some flexibility when drawing the support and resistance levels.

Experience shows that you are better off in plotting a range for support and resistance levels as it can help you to deal better with any spikes in prices. Now if you traded with just a single price level, chances are that you will get scared out of your position when there is a price spike. The first chart below shows a support level on a daily chart.

Figure 1: Support level example

In Figure 1, you can see that the support zone or a price region was selected. You can see that after first bouncing off this support level (or area of demand), price eventually falls back to this level at the very right side of the chart. From here, we can see another leg in the rally in price. The next example shows a resistance level on the chart.

Figure 2: Resistance level example

In Figure 2, you can see how the resistance level is plotted and how price reacts to it. Every rally to this region is met with resistance thus resulting in falling prices.

How Support and Resistance levels reverse in their roles?

So far we have learned that a support level is an area of demand with buyers in majority and as a result the higher demand leads to higher prices or a bounce. A resistance level is an area of supply and sellers in majority. As a result, price often falls from a resistance level. However, a support level can quickly change to become a resistance level and a resistance level can quickly change to become a support level. This reversal of roles occurs when price breaks past the level.

For example, if a support level was broken and price fell through the area of demand, you can expect this level to become resistance where supply or sellers will overwhelm the buyers. Similarly, a resistance level that is broken by price rallying above this level can quickly be tested by price as a support level as well. This reversal of support to resistance and resistance to support provides some great trading opportunities. The first example below shows how a support level turns to resistance and vice versa.

Figure 3: Support turns to resistance and resistance turns to support

What you see in figure 3 is the support level that was initially established. Following a brief bounce off this support level, price then breaks this support. After falling below this support, the rally back to this level is met with resistance.

This support turned resistance level is tested twice before price manages to break past this resistance. Obviously, there was a quick retest for support at this level before price managed to rally higher.

Entry and stop loss for support and resistance levels

By now it should be quite obvious on where to place your entries. Typically for long positions that you take a support level, you can set your entry to or close to above the support level. This will increase the chances of your trade being triggered. For stop loss, it is best to set the stop loss level a few pips below the support level. It is always best to look to the left for any key swing lows and set the stop loss level a few pips below this key swing low.

For short positions which typically occur at a resistance level, your entry will be a few pips below or close to the resistance level. And for stop loss levels, you would place your stops a few pips above the resistance level or a few pips above the nearest swing high. Don’t forget to also consider your risk/reward ratio when setting the stop loss levels.

The Rules in Trading Support and Resistance Lines

We can now summarize the rules for determining how to draw the support and resistance levels.

- A support level is where there are more buyers than sellers. Therefore, due to the high area of demand, price will often bounce or rally from a support level. Ideally, you are better positioned to be on the long side near a support level

- A resistance level is where there are more sellers than buyers. Therefore, due to the high area of supply, price will often fall or decline from a resistance level. Ideally, you are better positioned to be on the short side near a resistance level

- Support and resistance levels can either be a strict price point or a price zone

- Do not expect strict reversals at support or resistance levels. Price often tends to spike and take out the stops (also known as stop hunting) near the support and resistance levels

- A support or a resistance level can be broken. You will find this to happen when it coincides with a strong catalyst such as an economic release or comments from central banks

- When a support level breaks it turns to resistance and when a resistance level breaks, it can turn to support

- Identifying candlestick reversal patterns such as doji or Harami or engulfing candlestick patterns can help to improve your trading confidence with support and resistance levels

The post Understanding Support and Resistance Levels in Forex Trading appeared first on Advanced Forex Strategies.

from Advanced Forex Strategies