The Parabolic Curve Pattern, as the name suggests is a chart pattern that resembles that of a parabolic curve. It is not found that often, thus making it a very rare pattern in the markets. It is also one of the most sought after chart patterns as it signals a reversal in price. Although one might think that the parabolic curve requires price to move in a certain curved fashion, it is nothing but a series of sharp moves in price that can be plotted using multiple trend lines.

The Parabolic Curve Pattern usually occurs during sharp market movements. Such strong moves are led by a market speculation that gets ahead of itself. Traders often find themselves front-running an event. Thus, one of the common ways to identify a potential parabolic curve pattern is the period ahead of a bit event. An important point to note is that just because price moves in a parabolic shape it doesn’t mean that price will break the parabolic curve. There is a good chance that price will continue to move within this fashion for a significant period of time. This is eventually decided by the market forces.

How is the Parabolic Curve Pattern Formed?

The Parabolic Curve Pattern pattern is found usually in an uptrend. Here, you can expect prices to make shallow higher lows while posting strong higher highs. The first chart below in figure 1 shows a parabolic curve pattern.

Figure 1- Parabolic Curve Pattern

This is how an ideal Parabolic Curve Pattern looks like but is to be used only for reference purposes. In the real markets, you will seldom find such as text-book perfect parabolic pattern. Secondly, the parabolic curve is not really a curve but a series of trend lines that tend to become steeper when you plot the lows in price.

Sometimes, the pattern can require just two trend lines (a minimum of two trend lines is required, with the second trend line becoming steeper than the first one) and at times it can take even four or five trend lines. In figure 2, we have a sample parabolic curve pattern which takes just two trend lines. You can see that while the first trend line was inclined at an average of 45 degrees, the second trend line is steeper than the first.

Figure 2 – Parabolic Curve Pattern in EURUSD

Although the above pattern is not near the textbook illustration, you can see how the sharp move in price has caused the parabolic pattern. One important thing of note is the fact that it takes quite a while for the pattern to be formed. In most cases the parabolic pattern can be identified only close to or near the breakout of the pattern. Traders need to be quick in identifying this pattern and trade accordingly. The price action on the breakout can sometimes be very fast as traders begin to unwind their trades. Thus catching the trade at the right point is essential.

Why the Parabolic Curve Pattern is Powerful Reversal Trading Pattern?

The Parabolic Curve Pattern is a powerful chart pattern firstly because the price climbed too high and too fast. This kind of steep climb is not sustainable and a reversal in price is expected whenever this chart pattern occurs. Secondly, the time frame require to form the parabolic curve requires a lot of patience. Unlike other chart patterns such as the head and shoulders or the cup and handle pattern, the parabolic curve pattern can take a lot of time to form. Thus, traders need to be very patient in order for the parabolic curve pattern to be formed and to be ready when the breakout occurs.

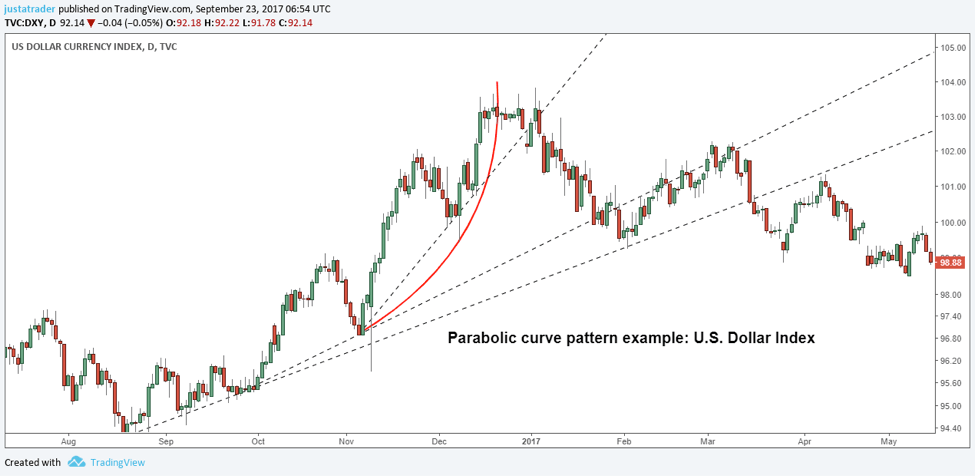

As noted earlier, the parabolic curve pattern comes due to speculative moves from the markets. For example in November last year as the U.S. Presidential elections concluded, the markets posted a strong rally in anticipation that Trump would announce fiscal stimulus measures that he promised during his campaign trail.

Figure 3 – Parabolic curve pattern breakdown in the U.S. Dollar Index

This led to the markets front-running the event even before an official announcement could be made. This sharp rally led to a parabolic shape projection in prices. As seen in figure 3, following the breakdown of the parabolic curve pattern, price posted a sharp decline.

How to effectively trade the Parabolic Curve Pattern

To effectively trade the parabolic curve pattern, the first step is to broadly look at all the instruments. Identify currency pairs where there has been a speculative move. Recent examples include the current rally in EURUSD which has been in an uptrend since June this year. Another example would be the GBPUSD rally which has posted sharp gains in just a matter of a month or two. Such strong moves in the markets typically result in a parabolic pattern breakout when the actual news falls short of market expectations.

The trading rules for the parabolic curve pattern are very simple. Because this pattern is formed in an uptrend, you will be looking at taking short positions. Start by plotting trendlines (minimum of two) and then plot the highs as well. The parabolic curve pattern is broken down into three bases; the first, second and third highs (figure 1). When you connect the lows of these three bases, you typically get the parabolic curve pattern. At the top end of the rally, after the parabolic curve is breached, wait for price to move below base 3 and go short. You can target bases 2 and 1 and book profits accordingly. The stops obviously come in at the top. Figure 4 shows the typical entry/exit and stop loss levels.

Figure 4 – Parabolic Curve Pattern trading rules

As you can see in the above illustration, after bases 1, 2 and 3 are formed, price breaks below the base 3 which triggers the short position. Eventually the targets of base 2 and 3 are eventually reached. The stops, set at the high can be moved to break even when you reach the first target.

The Parabolic Curve Pattern

To conclude, the parabolic curve pattern can be a powerful way to trade the markets. The general rule of the trading world is that if the price is climbing too fast, this kind of rise cannot be sustainable. The Parabolic Curve Pattern serves to point this rule to us and if we keep our emotions aside, it’s really not too difficult to spot the Parabolic Curve Pattern.

Do remember that price action can be extreme and it’s really not for the weak mind to trade this chart pattern. In order to be successful with trading this pattern, traders must focus on good money management skills and also must have some self confidence in their decision making. Good luck! Comment below to let us know your thoughts.

The post The Parabolic Curve Pattern appeared first on Advanced Forex Strategies.

from Advanced Forex Strategies