It isn’t possible to have decentralization, a fixed money supply and sufficient liquidity for an efficient payments system, says Frances Coppola.

via CoinDesk

Technical Outlook: The EURUSD continued to rally last week with prices briefly trading above the 1.2284 level. However, the EURO settled below this level as it is evident that resistance has been formed. With the ECB’s meeting due this week, the EURUSD could be seen pushing lower in the near term. Support is seen at 1.2182 level. A break down below this support could signal further declines to the main support at 1.2070 which is pending a retest following the strong rally off this level two weeks ago. Price action could remain range bound within 1.2284 and 1.2182 in the short term but the upside gains are likely to be limited.

Fundamental Outlook: The economic calendar from the Eurozone looks busy with a lot of economic data and forward looking indicators. Focus will be on the flash manufacturing and services PMI which dominate the economic calendar for the most part of the week. The data is expected to remain consistent across the board, indicating that the momentum in the sectors was entrenched. The ECB’s monetary policy meeting will of course remain the major highlight of the week. Following the details from the meeting minutes which suggested that ECB officials were contemplating tweaking its forward guidance, the markets will be keen to see if the ECB will follow through.

Previous EURUSD Weekly Forex Forecast

The post EURUSD Weekly Forex Forecast – 22nd to 26th Jan 2018 appeared first on Advanced Forex Strategies.

USDCHF Weekly Forex Forecast – 22nd to 26th Jan 2018

Technical Outlook: The USDCHF currency pair posted declines as it broke past the support level at 0.9741. The declines pushed the currency pair weaker to post fresh lows at 0.9535 level but soon recovered from the lows. We expect to see the upside momentum continuing to push USDCHF towads the 0.9741 level where resistance could be seen capping the gains. In the near term, USDCHF is seen to establish a range between the current lows and the resistance level mentioned. Further upside is possible but USDCHF could be limited to 0.9861 – 0.9894 levels.

Fundamental Outlook: Data from Switzerland this week is sparse. The major drivers of the fundamentals in the USDCHF currency pair will of course com from the U.S. data. The flash manufacturing and services PMI figures will be coming out this week and could provide an initial glimpse into the economy for the month of January. Later in the week, the U.S. advance GDP report for the fourth quarter will be closely watched. The U.S. durable goods orders report will also be released simultaneously.

Previous USDCHF Weekly Forex Forecast

The post USDCHF Weekly Forex Forecast – 22nd to 26th Jan 2018 appeared first on Advanced Forex Strategies.

USDJPY Weekly Forex Forecast – 22nd to 26th Jan 2018

Technical Outlook: The USDJPY currency pair slipped below the 110.91 – 110.66 level of support in the short term. Price action however managed to consolidate near this level as we see price closing back around this support level. The Stochastics oscillator is currently turning bullish and with price at support, we could expect to see some short term rebound in price action. The main resistance to the upside comes in at 112.07 region which could be the target. However, in the event that USDJPY fails to rebound off the current support then we can expect further declines to push the currency pair towards the 110.00 support.

Fundamental Outlook: Economic data from Japan looks to a busy week starting with the BoJ’s monetary policy meeting scheduled for Tuesday. The BoJ had announced a slight taper to its longer date bonds last week. This sent the Japanese yen surging. The BoJ’s meeting will be closely watched as investors look for clues towards potential tightening of the BoJ’s QQE program. Besides the BoJ’s meeting, other economic data over the week will cover the inflation report.

Previous USDJPY Weekly Forex Forecast

The post USDJPY Weekly Forex Forecast – 22nd to 26th Jan 2018 appeared first on Advanced Forex Strategies.

USDCAD Weekly Forex Forecast – 22nd to 26th Jan 2018

The Aussie has reached an important milestone after touching the big psychological number 0.8000. The current strong bullish run has reached a potential zone from where it can finally post a retracement. We couldn’t manage to post a strong close above 0.8000 and this can be the first warning for the bulls.

On the downside, the first area of interest only comes at 0.7930 followed by 0.7800 round number. The stochastic indicator is moving away from overbought condition which can suggest that at least we can see some type of consolidation. There is no major risk events scheduled on the Australian economic calendar. We should expect AUD/USD to be more technical driven this coming week.

Previous AUDUSD Weekly Forex Forecast

The post AUDUSD Weekly Forex Forecast – 22nd to 26th Jan 2018 appeared first on Advanced Forex Strategies.

USDCAD Weekly Forex Forecast – 22nd to 26th Jan 2018

The USDCAD is almost unchanged and finished the last week almost where it started. Since we’re still in a trading range between the last week low 1.2350 which can act now as support and the resistance level 1.2550, which is the top of the range. We can also note the big psychological number 1.2500 as an important resistance level.

A break and a daily close above 1.2550 can suggest that a swing low is in place, but until then we can’t rule out the bearish case which can see the USDCAD breaking below 1.2350. The stochastic indicator is in neutral territory not showing any signs of overbought or oversold market. The Canadian economic calendar only has one major risk event in the form of the CPI inflation figures. Based on the market consensus the CPI annualized rate should come flat at 2.1%. On Friday, we also have the US GDP figures for the last quarter of 2017 and the US economy is expected to post a 2.3% economic growth.

Previous USDCAD Weekly Forex Forecast

The post USDCAD Weekly Forex Forecast – 22nd to 26th Jan 2018 appeared first on Advanced Forex Strategies.

GBPUSD Weekly Forex Forecast – 22nd to 26th Jan 2018

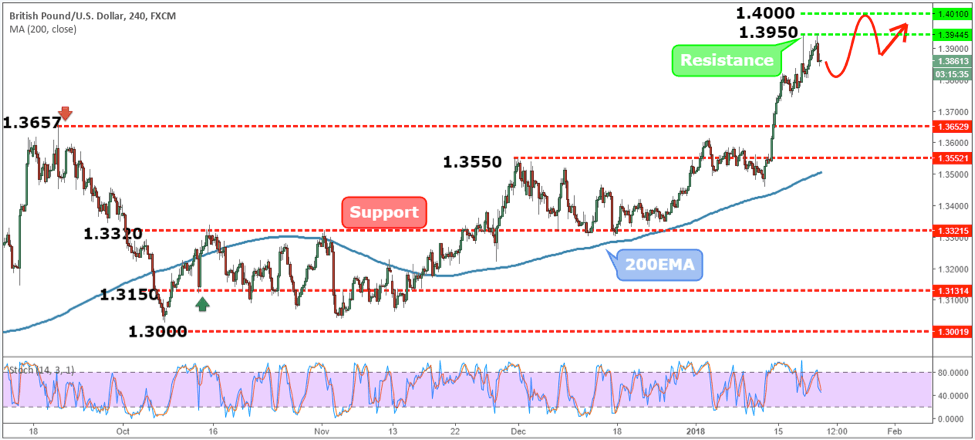

The GBPUSD bullish trend has continued to extend to the upside, reaching new higher grounds. Last week high at 1.3950 remains our key resistance level but a break above will expose the big psychological number 1.4000. A retest of the big round number 1.4000 can produce a reaction lower since the current bullish run seems overextended. On the downside we have as potential support the intraday support level 1.3750, but the more important support only come at 1.3657 previous swing high.

The stochastic indicator is not showing any signs of extreme sentiment in the market as it looks more neutral. The most likely scenario is for the GBPUSD to consolidate its current gains but only after another attempt to break towards 1.4000. The UK economic calendar only has some moderate risk events that can cause some volatility. On Wednesday we have the Unemployment figures which are expected to remain at 4.3% the lowest level since 1975. On Friday the UK GDP figures for the last quarter of 2017 will be released. The consensus is for the UK economy to post a 0.4% economic growth.

Previous GBPUSD Weekly Forex Forecast

The post GBPUSD Weekly Forex Forecast – 22nd to 26th Jan 2018 appeared first on Advanced Forex Strategies.