a-ads

Saturday, September 30, 2017

CryptoCurrency News: Guns & Crypto: How Bitcoin Is Helping Keep Cody Wilson's Anarchist Dream Alive

via CoinDesk

CryptoCurrency News: Zk-Starks? New Take on Zcash Tech Could Power Truly Private Blockchains

via CoinDesk

CryptoCurrency News: Philadelphia Fed Chief: Bitcoin Has Yet to Be Tested

via CoinDesk

Friday, September 29, 2017

CryptoCurrency: Ethereum News September 30, 2017 at 08:19AM #ETH

[MORE]

CryptoCurrency News: SEC Charges Promoter of Two ICOs with Fraud, Says 'REcoin' Had No Real Estate

via CoinDesk

CryptoCurrency News: IMF's Lagarde: Ignoring Cryptocurrencies 'May Not Be Wise'

via CoinDesk

CryptoCurrency: Ethereum News September 30, 2017 at 05:00AM #ETH

[MORE]

CryptoCurrency News: US Regulator: Cryptocurrencies May Pose Risks, Rewards for Credit Unions

via CoinDesk

CryptoCurrency News: US State Department to Host Blockchain Forum Next Month

via CoinDesk

CryptoCurrency News: Swiss Finance Regulator Is 'Investigating ICO Procedures'

via CoinDesk

CryptoCurrency News: VanEck's Bitcoin Futures ETF Effort Dealt Blow By SEC

via CoinDesk

CryptoCurrency News: Holding Strong? Ether Prices Dip to $280 as Korea Outlaws ICOs

via CoinDesk

CryptoCurrency News: Edward Snowden: Zcash Is 'Most Interesting Bitcoin Alternative'

via CoinDesk

CryptoCurrency News: DJ Khaled Is the Latest Celebrity to Promote an ICO

via CoinDesk

CryptoCurrency News: Prime Minister's Son to Head Barbados Bitcoin Startup

via CoinDesk

CryptoCurrency News: Japan's Finance Regulator Issues Licenses for 11 Bitcoin Exchanges

via CoinDesk

CryptoCurrency News: US Currency Boss Opens Door to Licensed Bitcoin Banks

via CoinDesk

CryptoCurrency News: South Korean Regulator Issues ICO Ban

via CoinDesk

CryptoCurrency News: Chilean Banking Regulator Enlists in R3 Blockchain Consortium

via CoinDesk

CryptoCurrency News: Telecom Giant KDDI Joins Enterprise Ethereum Alliance

via CoinDesk

[FOREX NEWS] Euro zone inflation misses with 1.5% – EUR/USD ticks down

Inflation is not going anywhere fast in the euro-zone: 1.5% y/y, standing in place. In addition, core inflation also slips to 1.1%, below predictions. EUR/USD ticks down to 1.1789. The preliminary inflation data for September was expected to show a small rise in y/y prices: 1.6% against 1.5% in August. Core inflation was forecast to [...]

The post Euro zone inflation misses with 1.5% – EUR/USD ticks down appeared first on Forex Crunch.

via Forex Crunch

[FOREX NEWS] UK GDP downgraded to 1.5% y/y – GBP/USD slips

Slightly worse than expected figures from the UK. While the economy still grew by 0.3% q/q, the final read for Q2 shows a lower annual growth rate at 1.5%. GBP/USD is slipping off the 1.34 handle The final read for UK GDP growth was expected to confirm the previous estimations: 0.3% q/q and 1.7% y/y. Britain’s [...]

The post UK GDP downgraded to 1.5% y/y – GBP/USD slips appeared first on Forex Crunch.

via Forex Crunch

CryptoCurrency News: Central Banker Reveals Unlikely Next Act: Helping Merchants Mint Cryptocurrency

via CoinDesk

Thursday, September 28, 2017

CryptoCurrency: Ethereum News September 29, 2017 at 08:50AM #ETH

[MORE]

CryptoCurrency News: Russia Likely to Ban Bitcoin Payments, Deputy Finance Minister Says

via CoinDesk

CryptoCurrency News: Wall Street Analyst Rejects Jamie Dimon's Bitcoin 'Fraud' Critique

via CoinDesk

CryptoCurrency News: Bull Trap? Bitcoin Prices Struggle to Build Momentum Above Moving Average

via CoinDesk

[FOREX NEWS] USD: US Tax Reform Proposal: ‘Next Comes the Hard Part’ – Nomura

Hopes for a significant reform in US taxes is one of the key drivers of the dollar. But the hard part still awaits: Here is their view, courtesy of eFXnews: Nomura Research comments on the yesterday’s release of US tax reform proposal noticing that its stated goals of the proposal are to reduce the complexity for [...]

The post USD: US Tax Reform Proposal: ‘Next Comes the Hard Part’ – Nomura appeared first on Forex Crunch.

via Forex Crunch

CryptoCurrency News: Former Virtu Trader Plans Decentralized Cryptocurrency Exchange

via CoinDesk

CryptoCurrency News: Two More Bitcoin Futures ETFs Are Up for SEC Approval

via CoinDesk

CryptoCurrency News: Canada's Biggest Bank Tests Blockchain for Cross-Border Payments

via CoinDesk

CryptoCurrency News: Australia's Securities Regulator Issues Formal Guidance For ICOs

via CoinDesk

CryptoCurrency News: Zcash's Wild Ride: Prices Spike to $400, Fall to $300, But What's Next?

via CoinDesk

[FOREX NEWS] US final GDP remains at 3.1%

No big surprises in the US GDP read. The third and final estimate of GDP growth for Q2 was projected to confirm the 3% growth rate that was reported in the second read. The first read stood at 2.6%. All in all, the second quarter was positive and served as a bounce back. The US [...]

The post US final GDP remains at 3.1% appeared first on Forex Crunch.

via Forex Crunch

CryptoCurrency News: Trump White House Doubles Down on US Commitment to Blockchain

via CoinDesk

[FOREX NEWS] German HICP misses expectations – stays at 1.8% y/y

more coming

The post German HICP misses expectations – stays at 1.8% y/y appeared first on Forex Crunch.

via Forex Crunch

CryptoCurrency News: Crypto Hedge Fund Costs? Invest $100k and Here's How Much You'd Pay

via CoinDesk

CryptoCurrency News: Nasdaq Teams with SEB for Blockchain Mutual Fund Trading Trial

via CoinDesk

CryptoCurrency News: Accenture Awarded Patent for 'Editable Blockchain' Tech

via CoinDesk

CryptoCurrency News: ICO First: Farm Collective Wins Clearinghouse Support for Token Sale

via CoinDesk

Wednesday, September 27, 2017

CryptoCurrency: Ethereum News September 28, 2017 at 07:34AM #ETH

[MORE]

CryptoCurrency: Ethereum News September 28, 2017 at 06:59AM #ETH

[MORE]

CryptoCurrency: Ethereum News September 28, 2017 at 06:21AM #ETH

[MORE]

CryptoCurrency News: Morgan Stanley CEO: Bitcoin Is 'More Than Just A Fad'

via CoinDesk

CryptoCurrency News: Ether Prices Climb Above $300 to Break Two-Week Lull

via CoinDesk

CryptoCurrency News: Staking Sidechains? New Paper Proposes Twist on Bitcoin Tech

via CoinDesk

[FOREX NEWS] USD/CAD breaks resistance on Poloz’s preoccupation

Stephen Poloz, the Governor of the Bank of Canada, gave an important speech in Saint John’s. He was cautious about inflation and about the next rate hikes. The BOC raised rates in July and then in September. No, there was no meeting in between. We have not seen back to back rate hikes for quite [...]

The post USD/CAD breaks resistance on Poloz’s preoccupation appeared first on Forex Crunch.

via Forex Crunch

CryptoCurrency News: Bitcoin Exchange BTCC Sets Deadline for Yuan Withdrawals

via CoinDesk

CryptoCurrency: Ethereum News September 28, 2017 at 02:59AM #ETH

[MORE]

CryptoCurrency News: US Government Awards $750k in New Blockchain Startup Grant

via CoinDesk

CryptoCurrency News: 'Wolf of Wall Street' Jordan Belfort: Jamie Dimon is Right About Bitcoin

via CoinDesk

CryptoCurrency News: Macau Finance Regulator Bars Banks from ICO Market

via CoinDesk

CryptoCurrency News: Forecaster Gerald Celente: Banks Are Afraid of Bitcoin

via CoinDesk

CryptoCurrency News: DASHed Hopes? Bullish Setup Fails as Price Looks Heavy

via CoinDesk

CryptoCurrency News: It's Political: Why China Hates Bitcoin and Loves the Blockchain

via CoinDesk

[FOREX NEWS] Schäuble to quit as German finance minister – good news for Greece

Bloomberg is reporting that the long-serving German finance minister Wolfgang Schäuble will step down as the country’s finance minister and will lead the German parliament, the Bundestag. The election resulted in a fractured parliament and Merkel would need a senior figure to lead the chamber. Schäuble is a fiscal hawk that led Europe’s austerity policy. He [...]

The post Schäuble to quit as German finance minister – good news for Greece appeared first on Forex Crunch.

via Forex Crunch

[FOREX NEWS] Good durables goods orders are good for the dollar

The figures come out better than expected: headline orders came out at 1.7% instead of 1% expected. More importantly, core orders came out at 0.2% as expected, but with an upward revision for the previous month. Another measure, excluding defense and air orders, is up 0.9%, triple the early expectations for 0.3%. The core-core figure [...]

The post Good durables goods orders are good for the dollar appeared first on Forex Crunch.

via Forex Crunch

CryptoCurrency News: Back Above $4,000: Bitcoin Price Eyes Next Major Upside Hurdle

via CoinDesk

CryptoCurrency News: Kik ICO Raises $98 Million But Falls Short of Target

via CoinDesk

CryptoCurrency News: Regulated ICOs Arrive: Overstock to Open Exchange for Legal Token Trading

via CoinDesk

CryptoCurrency News: Reports: Showtime Websites Used to Secretly Mine Cryptocurrency

via CoinDesk

CryptoCurrency News: Gold Dealer Sharps Pixley Begins Accepting Bitcoin

via CoinDesk

[FOREX NEWS] US dollar rages higher – 3 reasons and 5 pairs to watch

The US dollar is raging forward. This is more than a dead cat bounce, more than a small correction, and is somewhere between a big correction and an outright rally. Here are three reasons for the fall and updates on 5 currency pairs: Hopes for tax reform: The Trump Administration is expected to reveal more [...]

The post US dollar rages higher – 3 reasons and 5 pairs to watch appeared first on Forex Crunch.

via Forex Crunch

CryptoCurrency News: First Cash, Now Gold? Another Bitcoin Hard Fork Is on the Way

via CoinDesk

Tuesday, September 26, 2017

CryptoCurrency: Ethereum News September 27, 2017 at 08:40AM #ETH

[MORE]

CryptoCurrency: Ethereum News September 27, 2017 at 05:59AM #ETH

[MORE]

CryptoCurrency News: Watch: Jesse Ventura Moderates Colorado Governor Candidates in Colorful Bitcoin Debate

via CoinDesk

CryptoCurrency News: Ethereum Founder Vitalik Buterin Co-Authors Plan for 'Iterative' ICO Protocol

via CoinDesk

CryptoCurrency News: Ex-Fortress Billionaire: Crypto Market Will Be 'Largest Bubble of Our Lifetimes'

via CoinDesk

[FOREX NEWS] Yellen has doubts on inflation – USD falls

Fed Chair Janet Yellen says that the Fed may have misjudged inflation. She adds that low inflation is undesirable. more coming

The post Yellen has doubts on inflation – USD falls appeared first on Forex Crunch.

via Forex Crunch

CryptoCurrency News: USV's Fred Wilson Predicts 'Big' Cryptocurrency Crash

via CoinDesk

CryptoCurrency: Ethereum News September 26, 2017 at 11:38PM #ETH

[MORE]

CryptoCurrency News: Through the Roadblock? Bitcoin's Price Might Be Priming for a Boost

via CoinDesk

CryptoCurrency News: Mizuho CEO: Financial Firms 'Should Have Courage' on Blockchain

via CoinDesk

[FOREX NEWS] US new home sales disappoint with 560K – USD ticks down

Sales of new homes slipped by 3.4% to 560K in August, down from an upward revised 580K in July. Consumer confidence is also slightly below expectations: 119.8, marginally under 120 predicted. The US dollar is slightly lower after these figures, but the moves are minimal. Markets are awaiting Janet Yellen’s speech later today. The Conference [...]

The post US new home sales disappoint with 560K – USD ticks down appeared first on Forex Crunch.

via Forex Crunch

CryptoCurrency News: Gaming Firm to Buy $80 Million Stake in Korean Bitcoin Exchange Korbit

via CoinDesk

CryptoCurrency News: Bitcoin Businesses Face Bank Account Closures in Singapore

via CoinDesk

CryptoCurrency News: Like It or Not: Public Companies Are Feeling the Crypto Mining Boom

via CoinDesk

CryptoCurrency News: Banks Simulate €100,000 Security Transaction in R3 DLT Trial

via CoinDesk

CryptoCurrency News: Mario Draghi: European Central Bank Has 'No Power' to Regulate Bitcoin

via CoinDesk

CryptoCurrency News: Malta's Government May Test Cryptocurrency in Regulatory 'Sandbox'

via CoinDesk

CryptoCurrency News: Fintech Firm to Launch Cryptocurrency Exchange in South Korea

via CoinDesk

[FOREX NEWS] EUR/USD reaches one-month lows on the German elections aftermath

That weekend gap was more than telling. EUR/USD not only failed to close the gap but also extended its falls and reached the lowest levels in a month, trading at 1.1810. Support awaits the pair at 1.1780. This level served as a cushion in late August when the pair was moving to the upside. Further [...]

The post EUR/USD reaches one-month lows on the German elections aftermath appeared first on Forex Crunch.

via Forex Crunch

CryptoCurrency News: 'Big Four' Chinese Bank to Launch Blockchain Bancassurance Product

via CoinDesk

CryptoCurrency News: No Funny Business? MimbleWimble Won't ICO But Will Launch New Cryptocurrency

via CoinDesk

Monday, September 25, 2017

CryptoCurrency News: New SEC Cyber Unit to Police ICOs and Other DLT 'Violations'

via CoinDesk

CryptoCurrency: Ethereum News September 26, 2017 at 07:37AM #ETH

[MORE]

CryptoCurrency News: Ukrainian Central Banker: Bitcoin Is 'Definitely Not a Currency'

via CoinDesk

CryptoCurrency: Ethereum News September 26, 2017 at 05:28AM #ETH

[MORE]

CryptoCurrency News: Nigerian Central Bank Director: Cryptocurrency Wave 'Cannot Be Stopped'

via CoinDesk

CryptoCurrency: Ethereum News September 26, 2017 at 04:10AM #ETH

[MORE]

CryptoCurrency: Ethereum News September 26, 2017 at 03:44AM #ETH

[MORE]

CryptoCurrency News: Miner Argument Continues Over Ethereum's Byzantium Economics

via CoinDesk

CryptoCurrency News: Neo ICO Token Wins Traders as China Worries Fade

via CoinDesk

CryptoCurrency: Ethereum News September 26, 2017 at 12:57AM #ETH

[MORE]

[FOREX NEWS] North Korean threats: yet another buy-the-dip opportunity?

Another day, another escalation in the war of words. North Korea’s foreign minister said that the recent aggressive moves by the US constitute a “declaration of war”. He added that North Korea has the right to attack American “strategic bombers” also outside North Korean airspace. We have not heard this heightened rhetoric before, but we [...]

The post North Korean threats: yet another buy-the-dip opportunity? appeared first on Forex Crunch.

via Forex Crunch

CryptoCurrency News: Gibraltar to Regulate Bitcoin Exchanges, Possibly ICOs

via CoinDesk

CryptoCurrency News: Europe's Largest Port Launches Blockchain Research Lab

via CoinDesk

CryptoCurrency News: Wait and Watch? Bitcoin Prices Hover Near Make or Break Level

via CoinDesk

CryptoCurrency News: Barclays Joins CLS Blockchain Consortium in Search of Swift Alternative

via CoinDesk

CryptoCurrency News: US Centers for Disease Control to Launch First Blockchain Test on Disaster Relief

via CoinDesk

CryptoCurrency News: Japan's Bitcoin Exchanges Under Regulator Surveillance From October

via CoinDesk

[FOREX NEWS] EUR/USD follows the textbook on weekend gaps

Angela Merkel won as expected, but her party lost around 20% of its previous support. Most of the lost votes went to the extreme-right AfD, which came in third, a worrying sign. In addition, the most probable coalition, a three-way “Jamaica” coalition, will be harder to construct and more limited in reforming the euro-zone. All in all, [...]

The post EUR/USD follows the textbook on weekend gaps appeared first on Forex Crunch.

via Forex Crunch

CryptoCurrency News: FICO Patent Filing Hints at Plans for Bitcoin Exchange Monitoring

via CoinDesk

CryptoCurrency News: Hitachi and Mizuho Strike Deal for Blockchain Supply Chain

via CoinDesk

[FOREX NEWS] Five takeaways from the FOMC September Meeting

The Fed’s two-day monetary policy meeting concluded last week with the US dollar briefly rising as a result. The meeting was largely a non-event as the Fed did not waver too far from the market expectations. As expected, the central bank will be starting its balance sheet operations from October but in a somewhat surprise, [...]

The post Five takeaways from the FOMC September Meeting appeared first on Forex Crunch.

via Forex Crunch

CryptoCurrency News: Payment or Asset? Bitcoin's Limbo Is Leaving Merchants in the Middle

via CoinDesk

[FOREX NEWS] German IFO Business Climate misses with 115.2 – EUR slips

Business confidence is falling, and this happened before the election results. The IFO business climate dropped to 115.2, below expectations. Business Expectations slipped to 107.4 and the Current Assessment number is at 123.6. All the figures fall short of expectations but are not that far from the cycle highs. EUR/USD is ticking a bit lower, [...]

The post German IFO Business Climate misses with 115.2 – EUR slips appeared first on Forex Crunch.

via Forex Crunch

Sunday, September 24, 2017

[FOREX NEWS] EUR/USD could gap lower on the German election upset

The next German parliament will be fractured, very fractured and this means long and difficult coalition negotiations and a period of uncertainty. Angela Merkel’s CDU/CSU bloc came out first, but with a poor outcome: around 33% of the vote against around 40% projected. The other mainstream party, the SPD, was defeated as expected, but at [...]

The post EUR/USD could gap lower on the German election upset appeared first on Forex Crunch.

via Forex Crunch

[FOREX NEWS] German exit polls show Pyrrhic Victory for Merkel, AfD third

Merkel wins, but the result is not so good. CDU/CSU-EPP: 33.5% SPD-S&D: 21% AfD-ENF: 13% FDP-ALDE: 10% LINKE-LEFT: 9% GRÜNE-G/EFA: 9% — more coming Opinion polls leading into the elections showed a clear victory for Chancellor Angela Merkel’s CDU/CSU center-right coalition. She was expected to sail easily to a fourth and probably last term. The [...]

The post German exit polls show Pyrrhic Victory for Merkel, AfD third appeared first on Forex Crunch.

via Forex Crunch

CryptoCurrency News: Vivid History: 'How Money Got Free' Is the Untold Story of Bitcoin

via CoinDesk

CryptoCurrency News: Untangling Bitcoin: Why Russell Yanofsky Is Taking Apart Crypto's Oldest Code

via CoinDesk

Saturday, September 23, 2017

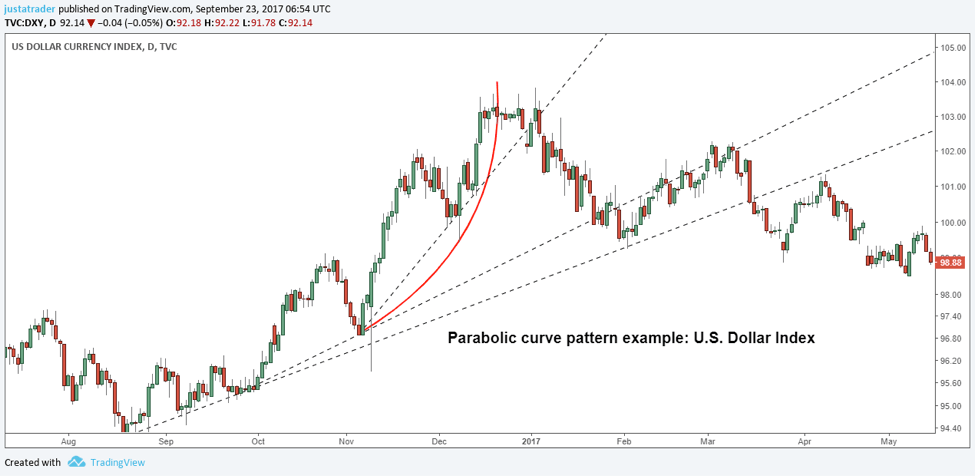

[FOREX TIP] The Parabolic Curve Pattern

The Parabolic Curve Pattern, as the name suggests is a chart pattern that resembles that of a parabolic curve. It is not found that often, thus making it a very rare pattern in the markets. It is also one of the most sought after chart patterns as it signals a reversal in price. Although one might think that the parabolic curve requires price to move in a certain curved fashion, it is nothing but a series of sharp moves in price that can be plotted using multiple trend lines.

The Parabolic Curve Pattern usually occurs during sharp market movements. Such strong moves are led by a market speculation that gets ahead of itself. Traders often find themselves front-running an event. Thus, one of the common ways to identify a potential parabolic curve pattern is the period ahead of a bit event. An important point to note is that just because price moves in a parabolic shape it doesn’t mean that price will break the parabolic curve. There is a good chance that price will continue to move within this fashion for a significant period of time. This is eventually decided by the market forces.

How is the Parabolic Curve Pattern Formed?

The Parabolic Curve Pattern pattern is found usually in an uptrend. Here, you can expect prices to make shallow higher lows while posting strong higher highs. The first chart below in figure 1 shows a parabolic curve pattern.

Figure 1- Parabolic Curve Pattern

This is how an ideal Parabolic Curve Pattern looks like but is to be used only for reference purposes. In the real markets, you will seldom find such as text-book perfect parabolic pattern. Secondly, the parabolic curve is not really a curve but a series of trend lines that tend to become steeper when you plot the lows in price.

Sometimes, the pattern can require just two trend lines (a minimum of two trend lines is required, with the second trend line becoming steeper than the first one) and at times it can take even four or five trend lines. In figure 2, we have a sample parabolic curve pattern which takes just two trend lines. You can see that while the first trend line was inclined at an average of 45 degrees, the second trend line is steeper than the first.

Figure 2 – Parabolic Curve Pattern in EURUSD

Although the above pattern is not near the textbook illustration, you can see how the sharp move in price has caused the parabolic pattern. One important thing of note is the fact that it takes quite a while for the pattern to be formed. In most cases the parabolic pattern can be identified only close to or near the breakout of the pattern. Traders need to be quick in identifying this pattern and trade accordingly. The price action on the breakout can sometimes be very fast as traders begin to unwind their trades. Thus catching the trade at the right point is essential.

Why the Parabolic Curve Pattern is Powerful Reversal Trading Pattern?

The Parabolic Curve Pattern is a powerful chart pattern firstly because the price climbed too high and too fast. This kind of steep climb is not sustainable and a reversal in price is expected whenever this chart pattern occurs. Secondly, the time frame require to form the parabolic curve requires a lot of patience. Unlike other chart patterns such as the head and shoulders or the cup and handle pattern, the parabolic curve pattern can take a lot of time to form. Thus, traders need to be very patient in order for the parabolic curve pattern to be formed and to be ready when the breakout occurs.

As noted earlier, the parabolic curve pattern comes due to speculative moves from the markets. For example in November last year as the U.S. Presidential elections concluded, the markets posted a strong rally in anticipation that Trump would announce fiscal stimulus measures that he promised during his campaign trail.

Figure 3 – Parabolic curve pattern breakdown in the U.S. Dollar Index

This led to the markets front-running the event even before an official announcement could be made. This sharp rally led to a parabolic shape projection in prices. As seen in figure 3, following the breakdown of the parabolic curve pattern, price posted a sharp decline.

How to effectively trade the Parabolic Curve Pattern

To effectively trade the parabolic curve pattern, the first step is to broadly look at all the instruments. Identify currency pairs where there has been a speculative move. Recent examples include the current rally in EURUSD which has been in an uptrend since June this year. Another example would be the GBPUSD rally which has posted sharp gains in just a matter of a month or two. Such strong moves in the markets typically result in a parabolic pattern breakout when the actual news falls short of market expectations.

The trading rules for the parabolic curve pattern are very simple. Because this pattern is formed in an uptrend, you will be looking at taking short positions. Start by plotting trendlines (minimum of two) and then plot the highs as well. The parabolic curve pattern is broken down into three bases; the first, second and third highs (figure 1). When you connect the lows of these three bases, you typically get the parabolic curve pattern. At the top end of the rally, after the parabolic curve is breached, wait for price to move below base 3 and go short. You can target bases 2 and 1 and book profits accordingly. The stops obviously come in at the top. Figure 4 shows the typical entry/exit and stop loss levels.

Figure 4 – Parabolic Curve Pattern trading rules

As you can see in the above illustration, after bases 1, 2 and 3 are formed, price breaks below the base 3 which triggers the short position. Eventually the targets of base 2 and 3 are eventually reached. The stops, set at the high can be moved to break even when you reach the first target.

The Parabolic Curve Pattern

To conclude, the parabolic curve pattern can be a powerful way to trade the markets. The general rule of the trading world is that if the price is climbing too fast, this kind of rise cannot be sustainable. The Parabolic Curve Pattern serves to point this rule to us and if we keep our emotions aside, it’s really not too difficult to spot the Parabolic Curve Pattern.

Do remember that price action can be extreme and it’s really not for the weak mind to trade this chart pattern. In order to be successful with trading this pattern, traders must focus on good money management skills and also must have some self confidence in their decision making. Good luck! Comment below to let us know your thoughts.

The post The Parabolic Curve Pattern appeared first on Advanced Forex Strategies.

from Advanced Forex Strategies

[FOREX TIP] AUDUSD Weekly Forex Forecast – 25th to 29th Sept 2017

AUDUSD Weekly Forex Forecast – 25th to 29th Sept 2017

The AUDUSD continues to respect the current consolidation range. Last week we weren’t able to sustain the gains above the big psychological number 0.8000 and more we even closed the week below the big round number. The current year high 0.8124 remains the big resistance level and while we trade below, we should expect at least more ranging activity.

We have an intraday support level at last week low 0.7908 followed by a much bigger support level at 0.7875. The stochastic indicator is also moving away from oversold conditions and we might expect the current minor bounce to continue early in the week. The view remains unclear as long as we trade within the limits of the current range. Only a break on either side of the range can be the catalyst for some trend development. There are no major risk events scheduled on the Australian economic calendar. In this regard, we should expect a more technical driven AUDUSD exchange rate.

Previous AUDUSD Weekly Forex Forecast

AUDUSD Weekly Forex Forecast – 25th to 29th Sept 2017

The post AUDUSD Weekly Forex Forecast – 25th to 29th Sept 2017 appeared first on Advanced Forex Strategies.

from Advanced Forex Strategies

[FOREX TIP] USDCAD Weekly Forex Forecast – 25th to 29th Sept 2017

USDCAD Weekly Forex Forecast – 25th to 29th Sept 2017

The USDCAD bearish trend has finally managed to take a pause and we saw a retracement. Last week high 1.2390 now remains an important resistance level and while we trade below this level we should expect the bearish trend to continue resuming downwards. A break above 1.2390 will expose 1.2410 and more importantly the big round number 1.2500.

The stochastic indicator is moving away from overbought conditions and now the downside has more changes to prevail. The first level of support comes in at 1.2250 followed by current year low 1.2064. A break and a close below 1.2064 will open up the door for a retest of the big psychological number 1.2000.

The Canadian economic calendar only has one major risk event scheduled on Friday when we have the Canadian GDP figures. The Canadian economy grow rate beat market expectation by 0.3% during the last month. According to IMF the Canadian economy is expected to have the fastest growth rate among G7 countries.

Previous USDCAD Weekly Forex Forecast

USDCAD Weekly Forex Forecast – 25th to 29th Sept 2017

The post USDCAD Weekly Forex Forecast – 25th to 29th Sept 2017 appeared first on Advanced Forex Strategies.

from Advanced Forex Strategies

[FOREX TIP] GBPUSD Weekly Forex Forecast – 25th to 29th Sept 2017

GBPUSD Weekly Forex Forecast – 25th to 29th Sept 2017

The GBPUSD has consolidated the recent gains and only closes the week slightly down from where it opened. We’re still trading above the big psychological number 1.3500 but we were only able to post a marginal weekly close above the round number. In this regard, we can’t rule out a deep below 1.3500 for a retest of intraday support level 1.3350.

The stochastic indicator also as some room left until it really enters in oversold territory, so it supports the idea of an early retest of 1.3350 before the bullish trend resume. Last week low 1.3450 remains another significant support level while on the upside, we have 1.3657 resistance level. A break and a daily close above last week’s high will open up the door for a retest of the 1.4000 big round numbers.

The UK economic calendar has enough risk events to cause some volatility in the market. On Monday we have the Financial Policy Committee, which includes assessment of potential risks to financial stability. Tuesday we have the Inflation Report Hearings while on Wednesday we have the UK GDP figures for the second quarter. The UK is expected to post an annualized rate of 1.7% economic growth rates. On Thursday, the US GDP figures are the main risk event and based on the market consensus we should expect the US economy to publish an impressive 3% growth rate.

Previous GBPUSD Weekly Forex Forecast

GBPUSD Weekly Forex Forecast – 25th to 29th Sept 2017

The post GBPUSD Weekly Forex Forecast – 25th to 29th Sept 2017 appeared first on Advanced Forex Strategies.

from Advanced Forex Strategies

[FOREX TIP] Weekly Forex News Events for EURUSD – 25th to 29th Sept 2017

EURUSD ended the week by producing a Doji candle on the Weekly chart. The next week has some high impact news events, thus the pair might make some interesting moves in the week ahead. Let us have a look at those news events.

Monday-25th September- GMT 13.00

ECB President Draghi speaks

This news event is always a big one for the EURUSD traders. Many opportunities can be found just after the news event.

Tuesday-26th September- GMT 14.00

CB consumer confidence

Intraday traders should be careful about this news event. It often produces spikes and sweeps away intraday stop losses.

Tuesday-26th September- GMT 16.45

Fed chair Yellen speaks

It is not as big as the ECB president’s speech. However, traders should be careful with their intraday positions before this news event hour.

Wednesday-27th September- GMT 12.30

Core durable goods orders m/m

This is another news event, which ends up producing long spike. Thus, intraday traders should deal with this carefully.

Wednesday-27th September- GMT 14.30

Crude oil inventories

It does not always get that volatile, but it has the potential to make the pair very volatile. Some good entries can be found after the news impact as well.

Thursday-28th September- GMT 12.30

Final GDP q/q/

Unemployment Claims

Basically, “Unemployment claims” data is going to make the pair volatile. EURUSD traders will wait for this news event to take some entries.

Friday-29th September- GMT 14.45

ECB President Draghi speaks

This would be his second speech in the next week. It can be assumed that this one would make the pair more volatile than the Monday’s one.

The post Weekly Forex News Events for EURUSD – 25th to 29th Sept 2017 appeared first on Advanced Forex Strategies.

from Advanced Forex Strategies

CryptoCurrency News: Welcome to Bitcoin Country: Silk Road and the Lost Threads of Agorism

via CoinDesk

CryptoCurrency News: Better in Byzantium? Ethereum Takes Baby Steps Toward a Privacy Boost

via CoinDesk

Friday, September 22, 2017

CryptoCurrency: Ethereum News September 23, 2017 at 08:45AM #ETH

[MORE]

CryptoCurrency: Ethereum News September 23, 2017 at 06:51AM #ETH

[MORE]

CryptoCurrency News: Money Manager Josh Brown: 'ICOs Are Where The Frauds Will Take Place'

via CoinDesk

CryptoCurrency: Ethereum News September 23, 2017 at 05:15AM #ETH

[MORE]

CryptoCurrency: Ethereum News September 23, 2017 at 03:50AM #ETH

[MORE]

CryptoCurrency News: EU Budget Amendments Call For Millions in Blockchain Funding

via CoinDesk

CryptoCurrency: Ethereum News September 23, 2017 at 02:40AM #ETH

[MORE]

CryptoCurrency News: Ethereum's 'Byzantium' Upgrade Postponed Until October 17

via CoinDesk

CryptoCurrency News: Investor Doug Casey: Bitcoin May Be Money, But It Still Might Fail

via CoinDesk

CryptoCurrency News: CFTC Sues New York Man Over Alleged $600k Bitcoin Ponzi Scheme

via CoinDesk

CryptoCurrency News: Gravity's Pull? Litecoin Is Down 50% from All-Time Highs and Looking Lower

via CoinDesk

[FOREX NEWS] GBP falls as May says “We never felt at home in the EU”

Theresa May began her all-important speech by highlighting the joint efforts of the UK and the EU, but her words about the UK “never feeling at home” are not very encouraging for the pound. She does want the negotiations to succeed to be a good partner of the European Union. GBP/USD is down to 1.3530. [...]

The post GBP falls as May says “We never felt at home in the EU” appeared first on Forex Crunch.

via Forex Crunch

CryptoCurrency News: Mastercard Hints at Plans for Blockchain Settlement System

via CoinDesk

[FOREX NEWS] Canadian data is mixed – USD/CAD bounces

Inflation in Canada is going nowhere fast: CPI is only up 0.1% m/m and core CPI is flat. Year over year, CPI is up 1.4% and core CPI stays unchanged at 0.9%. Retail sales are up 0.4%, but on top of a downward revision. Core sales are at 0.2%, and top of a downward revision, [...]

The post Canadian data is mixed – USD/CAD bounces appeared first on Forex Crunch.

via Forex Crunch

CryptoCurrency News: Uruguay's Central Bank Announces New Digital Currency Pilot

via CoinDesk

CryptoCurrency News: Dimon Knocks Bitcoin Again: Crackdown Likely on 'Worthless' Cryptocurrency

via CoinDesk

[FOREX TIP] Trading the 4 Types of Price Gaps

Trading the 4 Types of Price Gaps

Price gaps are a common occurrence in the markets these days. While there were quite rate in the forex markets, that changed over the past few years. Typically one gets to see gaps in the Forex markets on Monday’s open and at times, late into the U.S. trading session or in early Asian trading session. Trading gaps can offer a simple yet reliable way to trade. Gaps work on the principle that when there is a visible price difference between the previous session’s close and the current session’s open, it signals something to the markets.

Gaps occur due to strong buying or selling pressure. In such instances, prices jump at the next session’s open, leaving a gap. Gaps can be traded in many ways, but the closest resemblance is that gaps can be used as part of support and resistance trading as well. While gaps are easy to trade, one should remember that the price action can be swift which could lead to strong losses if not traded properly. However, for those who prefer to make quick gains, trading gaps can be a good way to day trade the markets. Gaps can occur as an up-gap or a down-gap and these can be broadly classified into the following four types of price gaps.

The 4 Types of Price Gaps

1. The Breakaway Gap

The breakaway gaps occur when price gaps higher or lower after trading in a range. When price gaps from the range, it can signal a strong move in the direction of the gap. The breakaway gap signifies that buyers or sellers eventually managed to overwhelm the range and eventually overpower the other side.

How is the Breakaway gap pattern formed?

A breakaway gap is formed around congestion or sideways markets. Usually, the more congested price is, the better the chances that a breakaway gap can be formed. To identify this gap, simply look for areas of consolidation in the price chart.

Figure 1 – Breakaway gap

How to Trade the Breakaway Gap?

In the above illustration you can see a breakaway gap in action. After a few sessions of consolidation, prices breakaway from the range and gaps lower. Trading this pattern requires some practice. In some cases, price seldom pulls back, but in the above example you can see how price retraced some part of the gap before pushing lower.

The best way to trade the breakaway gap is to wait for a retracement and when a local high is formed, you can then sell (or buy when a local low is formed in an up gap). The risk reward set up for such gaps depends on the trader itself.

2. The Runaway Gap

The Runaway Gap occurs as a result of increased interest in the market in question. These are also called as measuring gaps. Such gaps occur when the markets realize a bit late about the unfolding trend. A runaway gap typically occurs during the middle of a trend and can be used to signify trend continuation.

How is the Runaway Gap formed?

The runaway gap can be seen in the middle of a trend. Typically, in an uptrend you can find up gaps forming while in a downtrend, you can find down gaps forming. Such runaway gaps can signal that the price will continue moving in the same direction. However, pay attention to where the runaway gaps occur. Sometimes you might find that the runaway gap can occur late in the trend which can be disastrous as price can pose the risk of a strong reversal.

Figure 2 – Runaway gap

How to Trade the Runaway Gap?

The first step is to look for a trend that has been formed. In the above example (Figure 2) you can see the up gap that formed in the runaway gap. This comes after a strong uptrend previously. Combining the above information, long positions can be taken on the next session after the gap.

Stops can be placed at the pivot low below the gap with risk reward set to 2 or 3 times. Using other indicators such as moving averages or ADX to ascertain the trend can also help.

3. The Common Gap

The common gap or area gap can occur without any event backing the move. The main risk for such types of gaps is that they can be quickly filled. For example, price can gap higher in a common gap but this gap can be filled as price retraces back to the previous closing session which formed the gap.

How is the Common Gap formed?

The common gap is formed at regular intervals. These gaps can occur inside a range or even in a trend. The main differentiating factor is that common gaps tend to be filled almost immediately. Such gaps can be easy to identify and can signal a minor retracement before the previous trend resumes.

Figure 3 – Common Gap

How to Trade the Common Gap?

To trade the common gap successfully, simply wait for the gap to be filled. You can generally expect price to spike through or even close at the gap sometimes. Once the gap has been filled, you can take the position in the direction of the trend. Remember that a common gap simply shows a short term reversal. Therefore, in a downtrend, you can find an up gap which is the most common. Similarly, in an uptrend, you will find a down gap. Stops can be placed at the recent pivot high or low, above or below the common gap while profits can be booked based on the risk/reward ratio or other technical indicators.

4. The Exhaustion Gap

The exhaustion gap occurs at the top end of a rally or at the bottom end of a rally. Some common price action examples include island reversals where you can see prices gapping higher or lower before reversing direction. The exhaustion gap can be a good way to ascertain whether the trend in the market has exhausted and whether it is time for a correction or a pullback in prices.

How is the Exhaustion Gap Formed?

The exhaustion gap can be seen at the top or bottom in a trend. The exhaustion gap typically signals exhaustion to the trend. In some markets where true volume is found, you can see that the volume generally increases on these gaps. What follows the exhaustion gap is the reversal that takes place later. The reversal is in the opposite direction of the exhaustion gap. Thus the exhaustion gap can be viewed as an critical area during the reversals.

Figure 4 – The Exhaustion Gap

How to trade the exhaustion gap?

Once an exhaustion gap is identified, simply mark the gap. Of course, do not forget to see whether the gap occurred at the top of a rally or at the bottom of a downtrend. Once the gap has been identified, wait for price to break down below this gap or above the gap (following a downtrend). Stops can be placed at the pivot high or low above or below the gap and the profits can be booked based on a risk reward ratio set up or to the nearest support or resistance level.

Trading the 4 Types of Price Gaps

In conclusion, gaps are relatively easy to trade and can signal good market information and sentiment. With enough practice, traders will be able to easily identify the four types of price gap and trade accordingly. The most important when trading the 4 types of Price gaps is to maintain strict discipline and money management rule. If you can do this, then you will have a wonderful journey with Price Gaps. Good luck!

The post Trading the 4 Types of Price Gaps appeared first on Advanced Forex Strategies.

from Advanced Forex Strategies

CryptoCurrency News: Radical Academy: Amir Taaki's New Hacker Team Is Spreading Bitcoin in Syria

via CoinDesk

CryptoCurrency News: Australia's Origin Energy to Trial Blockchain Power Trading

via CoinDesk

CryptoCurrency News: Bitcoin Developers Reveal Roadmap for 'Dandelion' Privacy Project

via CoinDesk

CryptoCurrency News: Raiden ICO: Ethereum Scaling Solution to Launch Publicly Traded Token

via CoinDesk

[FOREX NEWS] German manufacturing PMI beats with 60.6 – EUR/USD rises

Business confidence is rising in Germany ahead of the elections. Manufacturing PMI topped the round number of 60 and hit 60.6 points. Services PMI also beat expectations by jumping to 55.6. These numbers reflect an acceleration in growth. EUR/USD is up from 20 pips to 1.1988. The move is not huge, but the pair extends [...]

The post German manufacturing PMI beats with 60.6 – EUR/USD rises appeared first on Forex Crunch.

via Forex Crunch

[FOREX NEWS] USD/JPY falls from highs on escalating North Korean threats

Tensions are mounting again around North Korea. The rogue regime’s leader Kum Jong-on reacted to Trump’s words in the United Nations and threatened a harsh response. Trump called Kim “rocket man” and Kim responded to Trump with “I will surely and definitely take the mentally deranged U.S. dotard with fire”. Other sources discuss a potential [...]

The post USD/JPY falls from highs on escalating North Korean threats appeared first on Forex Crunch.

via Forex Crunch

[FOREX NEWS] More Fed reactions: between a hawkish move to big doubts

We covered the Fed’s insistence to raise rates in December, how it helped the dollar and then provided four reasons to fade it. Here are 6 opinion Here is their view, courtesy of eFXnews: USD: A Fairly Hawkish FOMC Affair – NAB NAB Research comments on today’s FOMC September policy decision. “On the ‘dots’, 11 [...]

The post More Fed reactions: between a hawkish move to big doubts appeared first on Forex Crunch.

via Forex Crunch

Thursday, September 21, 2017

CryptoCurrency: Ethereum News September 22, 2017 at 07:02AM #ETH

[MORE]

CryptoCurrency News: Former CFTC Commissioner: Regulation Would Solve Bitcoin Volatility

via CoinDesk

CryptoCurrency: Ethereum News September 22, 2017 at 04:57AM #ETH

[MORE]

CryptoCurrency News: Nebraska Lawyers to Begin Accepting Bitcoin Following State Panel Approval

via CoinDesk

CryptoCurrency: Ethereum News September 22, 2017 at 04:07AM #ETH

[MORE]

CryptoCurrency News: Zcash Audit Finds No Serious Issues in Launch Ceremony Security

via CoinDesk

CryptoCurrency News: Gold Investor John Hathaway: Cryptocurrencies Are 'Garbage'

via CoinDesk

[FOREX NEWS] Fading the Fed – 4 reasons to doubt the hikes and the dollar rise

The US dollar jumped higher across the board as the Fed remains set to raise rates in December. Yet as the hours pass by, at least EUR/USD is already halfway back from low support, trading around 1.1940, up from the lows of 1.1860. Why does the dollar fail to extend its gains? Hurricanes: Sure, in [...]

The post Fading the Fed – 4 reasons to doubt the hikes and the dollar rise appeared first on Forex Crunch.

via Forex Crunch

CryptoCurrency News: Y Combinator President: Blockchain Can 'Democratize' Startup Investments

via CoinDesk

CryptoCurrency News: Weak Demand? Bitcoin's Price Rebound May Be Starting to Fade

via CoinDesk

CryptoCurrency News: Urbit Is Moving Its Virtual Server Galaxy Over to Ethereum

via CoinDesk

CryptoCurrency News: Blockchain History? IBM Ventures Is Close to Closing Its First Industry Investment

via CoinDesk

CryptoCurrency News: Australia Cites Blockchain In 'Digital Economy' Strategy Launch

via CoinDesk

[FOREX NEWS] AUD/USD just cannot hold onto 0.80

AUD/USD is now trading at 0.7950 after a “dead cat bounce” off the support line of 0.7940. The pair seemed to have settled above 0.80 and even temporarily touched 0.81, but it fell quite quickly. The battle for the round number is going on for a few months. Each time that the pair seems to [...]

The post AUD/USD just cannot hold onto 0.80 appeared first on Forex Crunch.

via Forex Crunch

CryptoCurrency News: CFTC Chair: Embracing Blockchain Is in the 'National Interest'

via CoinDesk

CryptoCurrency News: The EU Wants to Beef Up Penalties for Cryptocurrency Crimes

via CoinDesk

CryptoCurrency News: Searching for Problems? James Altucher to Bitcoin Critics, You're Dead Wrong

via CoinDesk

Wednesday, September 20, 2017

CryptoCurrency: Ethereum News September 21, 2017 at 08:30AM #ETH

[MORE]

CryptoCurrency: Ethereum News September 21, 2017 at 08:08AM #ETH

[MORE]

CryptoCurrency: Ethereum News September 21, 2017 at 07:47AM #ETH

[MORE]

CryptoCurrency: Ethereum News September 21, 2017 at 06:27AM #ETH

[MORE]

CryptoCurrency News: Swiss Telecom Giant Launches New Blockchain Business

via CoinDesk

CryptoCurrency: Ethereum News September 21, 2017 at 03:30AM #ETH

[MORE]

CryptoCurrency: Ethereum News September 21, 2017 at 03:12AM #ETH

[MORE]

CryptoCurrency News: CFTC Commissioner: Blockchain Will Bring 'Sea Change' to Financial Markets

via CoinDesk

[FOREX NEWS] EUR/USD falls to low support on the Fed dot-plot

The Fed always has excuses for low inflation in the present and foresees higher inflation in the future. The markets currently buy the optimism and send the dollar higher. EUR/USD crashes from 1.20 to support at 1.1910. Further support awaits at 1.1870. Follow the live coverage of the all-important Fed decision

The post EUR/USD falls to low support on the Fed dot-plot appeared first on Forex Crunch.

via Forex Crunch

[FOREX NEWS] Fed decides – live coverage

The Fed was widely expected to announce the beginning of Quantitative Tightening – beginning the reduction of its balance sheet. More importantly, markets are focused on the timing of the next rate hike. Will it happen in December? Here is the full preview: window to short the dollar and two other scenarios. Here is a live [...]

The post Fed decides – live coverage appeared first on Forex Crunch.

via Forex Crunch

CryptoCurrency News: Banks Are 'Afraid' of Bitcoin, Says Wealth Advisor

via CoinDesk

CryptoCurrency News: Japanese Billionaire: ICOs 'Democratize Venture Financing'

via CoinDesk

[FOREX TIP] Ascending Triangle and Descending Triangle Chart Pattern Analysis

Triangle Chart Pattern Analysis

The Ascending and Descending Triangle Chart Patterns come under the category of reversal patterns. When these patterns are formed, you can expect the market to breakout from the pattern and post a reversal. This reversal can be either a change of trend or simply a retracement to the prevailing trend. The ascending and descending triangles, as the name suggests are bullish and bearish. There doesn’t have to be a strong trend for these patterns to occur and in most cases, you can often find these patterns emerging during sideways markets. In this article, we explore the details of the ascending and descending triangle patterns and how you can trade these reversal chart patterns effectively.

How is the Triangle Chart Pattern formed?

The ascending and descending triangle patterns are formed with prices making consecutive higher lows but meeting with a horizontal resistance, or price making a series of lower highs but meeting with a horizontal support level. The patterns are quite visible when you plot the horizontal support or resistance level and connect the highs and the lows which are slanting.

Although these patterns are considered to be reversal patterns, traders should be cautious as there are instances when price breaks out of the rising or falling trend line and continues to move in the opposite direction. This can be quite disastrous for those who wish to seek an early entry into the market. While this method can give you additional rewards, there is also a potential of being caught on the wrong side of the market. This is something unique to the ascending and descending triangle patterns and traders should therefore be very careful when trading these reversal patterns.

Trading the Ascending Triangle Chart Pattern

The ascending triangle pattern, as mentioned earlier is based on a horizontal resistance level. Price retests this level at regular intervals but fails to break it. As a result, price continues to move lower, but makes higher lows (which gives the name, ascending triangle). In figure 1, we have an example of an ascending triangle pattern.

Figure 1 – Ascending Triangle Pattern Structure

As you can see in the above example, the ascending triangle is formed when price repeatedly tests the resistance level but fails to break it. In the mean time, every test of resistance results in price action making higher lows. When you connect these higher lows, you can see an inclined or rising trend line. Combining the horizontal resistance and the rising trend line, you get the ascending triangle pattern. The measured move is based on measuring the distance from the first low point to the resistance level and then projecting the same from the resistance level to the upside.

Ascending Triangle Chart Pattern Trading Rules

The trading rules for the ascending triangle pattern are very simple. Once the breakout of the resistance occurs, long positions are taken. Stops are placed at the recent swing low point. You can book profits at regular intervals. Note that sometimes, price can also drop back to retest the resistance level for support, which can bring additional opportunities to go long on the pattern. The next chart below shows an example of the ascending triangle breakout pattern.

Figure 2 – Ascending Triangle Chart Pattern Breakout

In the above example, you can see how price initially rallied to the resistance but then made a low. Following this, price then makes subsequent higher highs and then retests the resistance level. After this you can see how price makes a breakout from the resistance level. Long positions are taken on the breakout and stops placed at the swing low point. In the above example, you can also see that price dips back to the resistance level to establish support, twice before rallying to the measured move target.

Trading the Descending Triangle Chart Pattern

The descending triangle pattern as the name suggests is marked by a series of lower highs and price unable to break the support in the process. What follows next is the breakout from the support level. This leads to a strong decline in prices. What is noticeable about the descending triangle pattern is the series of lower highs that are formed. Figure 3 shows an example of the descending triangle pattern.

Figure 3 – Descending Triangle Chart Pattern

In the above example you can see how the breakout to the downside results in price action pushing lower after the support level is broken. The trading rules for the descending triangle pattern are similar to that of the ascending triangle pattern. Stops would be placed at the recent swing high following the breakout of the support level. The target is based on the measured move from the highest point to the support level and this is projected lower.

The Symmetrical Triangle Chart Pattern

Besides the ascending and descending triangle pattern, the symmetrical triangle pattern is another commonly occurring chart pattern. What’s unique about the symmetrical triangle pattern is the breakout. The breakout from this pattern will decide whether prices will rally or fall. Figure 4 illustrates the symmetrical triangle pattern. Here, you can see that the breakout can occur in either direction.

Figure 4 – The Symmetrical Triangle Chart Pattern

Once the breakout level is determined, the projection is taken from the high and the low of the symmetrical triangle pattern. Stops for the symmetrical triangle are placed either at the recent swing low prior to an upside breakout or a recent swing high prior to a downside breakout.

To conclude, the ascending and descending triangle patterns are simple to trade and occur quite frequently. While you can already determine the direction of the breakout with the ascending and descending triangles, with the symmetrical triangle, traders need to be a bit more patient as price can breakout in either directions.

The post Ascending Triangle and Descending Triangle Chart Pattern Analysis appeared first on Advanced Forex Strategies.

from Advanced Forex Strategies

Popular Posts

-

Before you continue, we want to make sure you understand that this is a past trade idea found inside The Price Action Club which is a premi...

-

The companies behind three blockchain platforms have unveiled a new advocacy group focusing on interoperability between disparate networks...

-

The man behind one of the crypto industry's most popular memes speaks out on his philosophy toward cryptocurrency and its future. vi...

-

BNP Paribas has partnered with Indian IT firm Tata Consultancy Services to bring blockchain's reliability to corporate event announcem...

-

The Island Reversal Gap Chart Pattern is a commonly occurring chart pattern in the stock markets. In fact the name comes from the stock mar...

-

The price of bitcoin is trading above $4,000, its highest level in two weeks, a move that was backed by strong volume. via CoinDesk

-

Giving up full decentralization could solve many of blockchain's existing problems, says Yao Qian, research director at China's ce...

-

Chart patterns are one of the most effective trading tools for a trader. They are pure price-action, and form on the basis of underlying bu...

-

Users of the cryptocurrency exchange Kraken are taking action over the startup's alleged mismanagement of a flash crash in its ether ord...

-

Blockchain is now being touted as a way to revive a long-promised method of boosting financial access for the underbanked. via CoinDesk ...